VIDEO

Deconstruction of Lommel wind farm

The key concepts of diversification and risk spreading will prevail in the future for the group's further growth. The multi-tier company structure, collaborations with specialist partners and a geographical distribution of activities, among other things, will be maintained.

The Aspiravi group's figures are the result of the daily efforts of all staff and the consistent policy of the directors. Their efforts determine the course the group has taken and the direction in which it continues. The Aspiravi group's future plans remain ambitious: progressing the group's sustainable growth and contributing towards the necessary energy transition. We will continue this work along with you.

millions of

€ 20

Profit

millions of

€ 216

Turnover

millions of

€ 778

Fixed assets

millions of

€ 270

Shareholders' equity

millions of

€ 1,009

Balance sheet total

Over 20 years, the consolidated balance sheet of Aspiravi Holding has evolved to a balance sheet total of 1,009 million euros with shareholders' equity of 270 million euros and fixed assets with a value of 778 million euros. A turnover of 216 million euros was realised and a profit of 20 million euros. From this strong financial position, future projects can be financed by Aspiravi Holding itself, supplemented by business loans and capital generated by the co-operative societies. Since its creation, the value of Aspiravi Holding has multiplied with more than 22. In addition, the regional holding companies of municipal shareholders also receive a very good annual dividend, which has already totalled more than 104 million euros since the creation of Aspiravi Holding.

The Aspiravi group attaches very great importance to clear and unambiguous communication. Not only is care taken with social support and embedding each project among the public, but the principles of sound management and transparency are also applied continually in practice. Clear information is central to the development, construction and operation of all projects, as well as the provision of open and transparent information on financial data.

The profit and loss account and the balance sheet are not only available for consultation in this online corporate brochure, but are also available at any time on the company's website.

FINANCIAL POLICY AND CORE FIGURES FOR THE ASPIRAVI GROUP

Aspiravi Trading NV trades in electrical energy, green power certificates, cogeneration certificates and guarantees of origin.

Aspiravi Energy has been active on the electricity market since 2015 and supplies locally produced green electricity. Per consumed megawatt hour, Aspiravi Energy also donates an amount to a social cause against energy or child poverty.

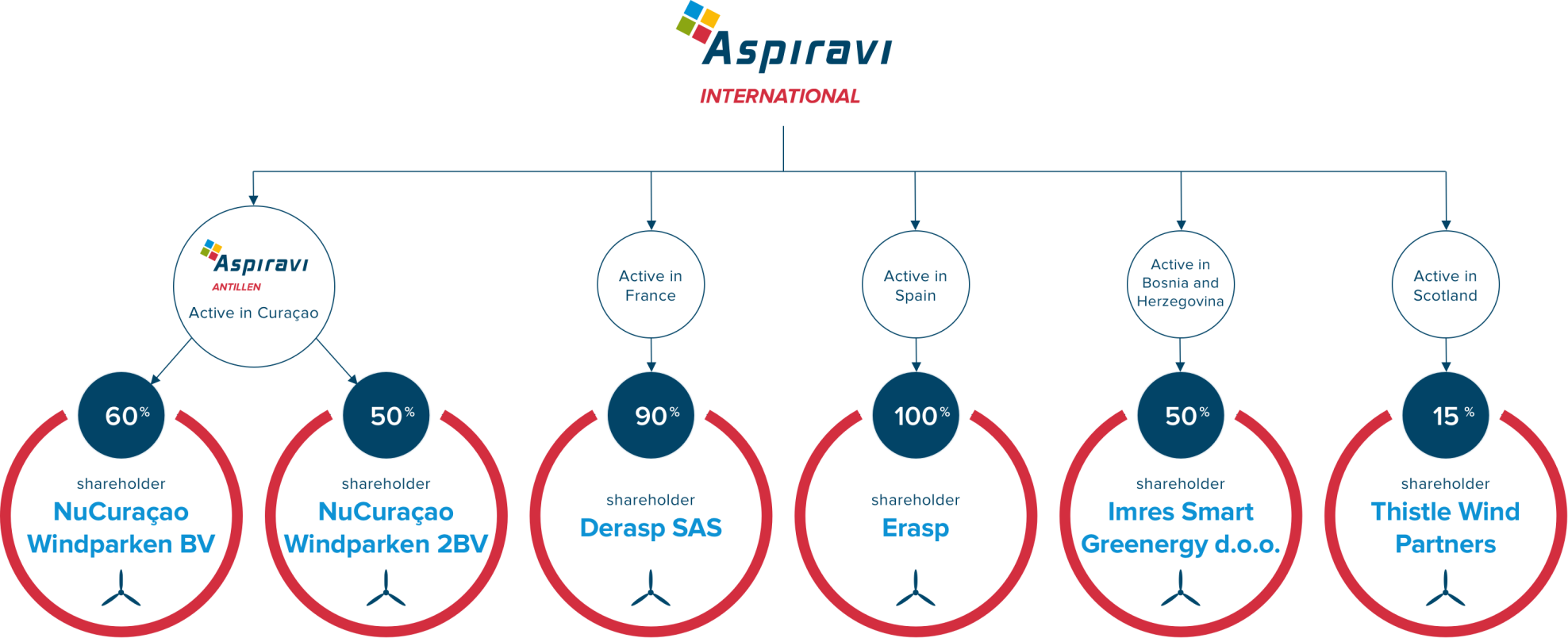

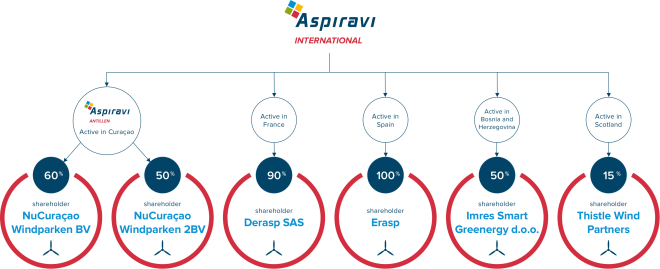

View the core shareholdings of Aspiravi International NV here.

The group has been developing projects abroad through Aspiravi International NV since 2010/2011. The wind energy projects on the island of Curaçao are combined under Aspiravi Antillen NV, which in turn is a shareholder in NuCuraçao Windparken BV (60%) and NuCuraçao Windparken 2BV (50%). In Bosnia and Herzegovina, this takes place through a shareholding in Imres Smart Greenergy d.o.o. (50%). In France, Aspiravi International NV is participating in the development of renewable energy projects through the company Derasp SAS (90%). In Spain, Aspiravi International NV has established the company Erasp (100%). Finally, Aspiravi International NV is also a shareholder in Thistle Wind Partners (15%) for the development of offshore wind energy projects in Scotland today.

View the core shareholdings of Aspiravi Offshore II NV here.

Aspiravi Offshore II NV is involved with the Rentel NV (12.5%) and SeaMade NV (8.75%) (Seastar and Mermaid) wind farms through the company Otary RS NV (12.5%). Otary is a partnership of eight major Belgian players in offshore wind energy.

View the core shareholdings of Aspiravi Offshore NV here.

Aspiravi Offshore NV is the main shareholder (40%) of the Northwind NV wind farm. Through Northwind, Aspiravi Offshore NV is a shareholder (23.6%) of Cableco CV, which owns the export cable linking the mainland to the high-voltage substation at sea. Aspiravi Offshore NV is also a direct shareholder (50%) of A&P Wind Services NV, which is in charge of operational and financial management of Northwind and Cableco.

The group carries out onshore projects in Belgium via the company Aspiravi NV. This is done either directly or by shareholdings in other companies.

In the province of Limburg, the Aspiravi group is active as a shareholder of Limburg win(d)t NV (66.7%) and Lommel win(d)t NV (66.7%). In the province of Antwerp, projects are being implemented on the right bank of the port as a shareholder of Vleemo NV (50%) and on the left bank as a shareholder of Wind aan de Stroom NV (14.4%). Aspiravi is also a shareholder in: Groene Energie Haven Antwerpen NV (57.5%), A&S Energie (50%) and A&U Energie (50%), both of the power stations for the incineration of non-recyclable wood waste.

View the shareholder structure for Aspiravi Holding here.

Aspiravi Holding is a shareholder (84.9%) of Aspiravi, Aspiravi Offshore and Aspiravi International, along with the Vlaamse Energieholding (15.1%). The holding is the 100% shareholder of Aspiravi Offshore II, Aspiravi Trading and Aspiravi Energy.

CORE SHAREHOLDINGS

The Aspiravi group's shareholders are further expanding the renewable energy market through carefully selected and well-designed wind farms and power stations for non-recyclable wood waste in Belgium, the North Sea and abroad.

The investment yields of the Aspiravi group flow back to the municipal shareholders, who in turn invest these amounts for the benefit of their residents. The extensive shareholder structure and the various core shareholdings of the Aspiravi group require a transparent policy, whereby information is shared consistently and step-by-step between the various levels.

View the overview of the Aspiravi group's shareholders here.

VIDEO

Deconstruction of Lommel wind farm

View the consolidated annual account and the balance sheet for Aspiravi Holding here.

CREADIV

Flemish and Walloon Brabant

VEH

SHAREHOLDERS OF

THE ASPIRAVI GROUP

NUHMA

Limburg

FINEG

Antwerp and East Flanders

EFIN

West Flanders

The key concepts of diversification and risk spreading will prevail in the future for the group's further growth. The multi-tier company structure, collaborations with specialist partners and a geographical distribution of activities, among other things, will be maintained.

The Aspiravi group's figures are the result of the daily efforts of all staff and the consistent policy of the directors. Their efforts determine the course the group has taken and the direction in which it continues. The Aspiravi group's future plans remain ambitious: progressing the group's sustainable growth and contributing towards the necessary energy transition. We will continue this work along with you.

millions of

€ 20

Profit

millions of

€ 216

Turnover

millions of

€ 778

Fixed assets

millions of

€ 270

Shareholders' equity

millions of

€ 1,009

Balance sheet total

Over 20 years, the consolidated balance sheet of Aspiravi Holding has evolved to a balance sheet total of 1,009 million euros with shareholders' equity of 270 million euros and fixed assets with a value of 778 million euros. A turnover of 216 million euros was realised and a profit of 20 million euros. From this strong financial position, future projects can be financed by Aspiravi Holding itself, supplemented by business loans and capital generated by the co-operative societies. Since its creation, the value of Aspiravi Holding has multiplied with more than 22. In addition, the regional holding companies of municipal shareholders also receive a very good annual dividend, which has already totalled more than 104 million euros since the creation of Aspiravi Holding.

FINANCIAL POLICY AND CORE FIGURES FOR THE ASPIRAVI GROUP

The Aspiravi group attaches very great importance to clear and unambiguous communication. Not only is care taken with social support and embedding each project among the public, but the principles of sound management and transparency are also applied continually in practice. Clear information is central to the development, construction and operation of all projects, as well as the provision of open and transparent information on financial data.

The profit and loss account and the balance sheet are not only available for consultation in this online corporate brochure, but are also available at any time on the company's website.

Aspiravi Trading NV trades in electrical energy, green power certificates, cogeneration certificates and guarantees of origin.

Aspiravi Energy has been active on the electricity market since 2015 and supplies locally produced green electricity. Per consumed megawatt hour, Aspiravi Energy also donates an amount to a social cause against energy or child poverty.

CORE SHAREHOLDINGS OF ASPIRAVI INTERNATIONAL NV AND ASPIRAVI ANTILLEN NV

The group has been developing projects abroad through Aspiravi International NV since 2010/2011. The wind energy projects on the island of Curaçao are combined under Aspiravi Antillen NV, which in turn is a shareholder in NuCuraçao Windparken BV (60%) and NuCuraçao Windparken 2BV (50%). In Bosnia and Herzegovina, this takes place through a shareholding in Imres Smart Greenergy d.o.o. (50%). In France, Aspiravi International NV is participating in the development of renewable energy projects through the company Derasp SAS (90%). In Spain, Aspiravi International NV has established the company Erasp (100%). Finally, Aspiravi International NV is also a shareholder in Thistle Wind Partners (15%) for the development of offshore wind energy projects in Scotland today.

Aspiravi Offshore II NV is involved with the Rentel NV (12.5%) and SeaMade NV (8.75%) (Seastar and Mermaid) wind farms through the company Otary RS NV (12.5%). Otary is a partnership of eight major Belgian players in offshore wind energy.

*direct and/or indirect shareholder

CORE SHAREHOLDINGS OF ASPIRAVI OFFSHORE II NV

*direct and/or indirect shareholder

CORE SHAREHOLDINGS OF ASPIRAVI OFFSHORE NV

Aspiravi Offshore NV is the main shareholder (40%) of the Northwind NV wind farm. Through Northwind, Aspiravi Offshore NV is a shareholder (23.6%) of Cableco CV, which owns the export cable linking the mainland to the high-voltage substation at sea. Aspiravi Offshore NV is also a direct shareholder (50%) of A&P Wind Services NV, which is in charge of operational and financial management of Northwind and Cableco.

*direct and/or indirect shareholder

CORE SHAREHOLDINGS OF ASPIRAVI NV

The group carries out onshore projects in Belgium via the company Aspiravi NV. This is done either directly or by shareholdings in other companies.

In the province of Limburg, the Aspiravi group is active as a shareholder of Limburg win(d)t NV (66.7%) and Lommel win(d)t NV (66.7%). In the province of Antwerp, projects are being implemented on the right bank of the port as a shareholder of Vleemo NV (50%) and on the left bank as a shareholder of Wind aan de Stroom NV (14.4%). Aspiravi is also a shareholder in: Groene Energie Haven Antwerpen NV (57.5%), A&S Energie (50%) and A&U Energie (50%), both of the power stations for the incineration of non-recyclable wood waste.

SHAREHOLDERS STRUCTURE

OF ASPIRAVI HOLDING

Aspiravi Holding is a shareholder (84.9%) of Aspiravi, Aspiravi Offshore and Aspiravi International, along with the Vlaamse Energieholding (15.1%). The holding is the 100% shareholder of Aspiravi Offshore II, Aspiravi Trading and Aspiravi Energy.

CORE SHAREHOLDINGS

SHAREHOLDERS AND SHAREHOLDER STRUCTURE

SHAREHOLDINGS

STRUCTURE, CORE

The Aspiravi group is a 100% Belgian group that has been active in the renewable energy sector since 2002. The Aspiravi group's strategy and policies are determined by its Board of Directors and approved at its annual General Assembly. This is where its shareholders are represented. These shareholders are 4 regional holdings, Creadiv, Efin, Fineg and Nuhma who together represent 94 Belgian cities and municipalities, and the Vlaamse Energieholding (VEH). They, in turn, are accountable to their Boards of Directors and to their General Assemblies, at which all 94 municipalities concerned are directly represented and exercise control.

AND POLICY

STAKEHOLDER

The Aspiravi group's shareholders are further expanding the renewable energy market through carefully selected and well-designed wind farms and power stations for non-recyclable wood waste in Belgium, the North Sea and abroad.

The investment yields of the Aspiravi group flow back to the municipal shareholders, who in turn invest these amounts for the benefit of their residents. The extensive shareholder structure and the various core shareholdings of the Aspiravi group require a transparent policy, whereby information is shared consistently and step-by-step between the various levels.